Intro

As an investor, it is important to stay abreast of the latest developments in the stock market. Nasdaq FintechZoom is an index that tracks the performance of stocks in the financial technology (fintech) sector. This index is a great tool for investors to track the performance of this quickly-evolving sector, allowing them to make informed decisions and capitalize on the growth of fintech investments. By following the Nasdaq FintechZoom, investors can get a better understanding of the current state of fintech investments and how they can benefit from them.

What is Nasdaq FintechZoom?

Nasdaq FintechZoom is an index that specifically focuses on the financial technology (fintech) sector. This index is designed to track the performance of stocks in the fintech industry, which includes companies that provide innovative financial services and technologies.

Unlike other general market indices, such as the S&P 500 or Dow Jones Industrial Average, Nasdaq FintechZoom allows investors to specifically monitor the performance of fintech companies. This is crucial because the fintech sector is rapidly growing and evolving, making it an attractive area for investors looking for potential opportunities.

By tracking Nasdaq FintechZoom, investors can gain insights into the overall health and growth of the fintech industry. This includes identifying trends, evaluating the performance of specific fintech companies, and staying updated on any significant developments or news within the sector. Additionally, Nasdaq FintechZoom provides investors with a benchmark against which they can compare the performance of their own fintech investments.

Overall, Nasdaq FintechZoom is a valuable tool for investors interested in the fintech industry. It allows them to stay informed, make informed decisions, and potentially benefit from the growth and potential of this rapidly expanding sector.

Why it’s important for investors to pay attention

In today’s fast-paced financial landscape, it is crucial for investors to pay close attention to the ever-evolving world of fintech. The fintech industry is experiencing rapid growth and disruption, with new technologies and innovative services emerging on a regular basis. As an investor, staying informed about these developments is essential to capitalize on the opportunities presented by this sector.

This is where Nasdaq FintechZoom comes in. By tracking the performance of stocks in the fintech industry, Nasdaq FintechZoom provides investors with valuable insights into the health and growth of this sector. It allows investors to identify trends, evaluate the performance of specific fintech companies, and stay updated on any significant news or developments.

Paying attention to Nasdaq FintechZoom is particularly important because the fintech industry is becoming increasingly intertwined with traditional finance. Fintech companies are disrupting established industries like banking, lending, and insurance, and are poised to capture a significant share of these markets. By monitoring the performance of fintech stocks, investors can gauge the potential impact on their own investments and adjust their strategies accordingly.

Understanding the Fintech industry

The fintech industry is revolutionizing the way we think about and engage with financial services. Understanding this rapidly evolving industry is essential for investors looking to capitalize on its potential. Fintech, short for financial technology, encompasses a wide range of companies that leverage technology to deliver innovative financial products and services.

One of the key drivers behind the rise of fintech is the increasing demand for convenient, efficient, and accessible financial solutions. Traditional financial institutions often come with high fees, cumbersome processes, and limited accessibility. Fintech companies, on the other hand, use technology to provide seamless and user-friendly financial services, such as mobile banking, peer-to-peer lending, and digital payments.

By embracing cutting-edge technologies like artificial intelligence, blockchain, and data analytics, fintech companies are able to streamline processes, reduce costs, and create personalized experiences for consumers. This has led to increased competition within the financial industry and a shift in consumer behavior.

Investing in fintech can be highly lucrative, as the sector continues to experience rapid growth and disruption. However, it is important for investors to understand the unique dynamics of this industry. Fintech companies often face regulatory challenges, cybersecurity risks, and the need to constantly innovate to stay ahead of the competition.

Overall, the fintech industry represents a significant opportunity for investors. Understanding its intricacies, trends, and challenges will allow investors to make informed decisions and potentially benefit from the growth and innovation that fintech offers. Nasdaq FintechZoom serves as a valuable tool in tracking the performance of this industry, providing investors with valuable insights into the ever-evolving world of fintech.

How Nasdaq FintechZoom fits in

Nasdaq FintechZoom is a powerful tool that fits perfectly into the fast-paced world of fintech investing. It provides investors with the unique ability to track the performance of stocks in the fintech industry, giving them valuable insights into the ever-evolving landscape of financial technology.

By monitoring Nasdaq FintechZoom, investors can gain a better understanding of the health and growth of the fintech sector. They can identify emerging trends, evaluate the performance of specific fintech companies, and stay up to date on any significant news or developments. This knowledge allows investors to make informed decisions and adjust their strategies accordingly, potentially capitalizing on the growth and innovation of fintech.

What sets Nasdaq FintechZoom apart is its laser-focus on the fintech industry. Unlike other market indices that cover a broad range of sectors, Nasdaq FintechZoom hones in specifically on the companies that are driving the fintech revolution. This allows investors to dig deeper into the fintech industry and get a clearer picture of its potential.

In addition, Nasdaq FintechZoom serves as a benchmark for investors. It provides a point of comparison for the performance of their own fintech investments, giving them a reliable gauge to measure their success.

Overall, Nasdaq FintechZoom is a must-have tool for investors interested in the fintech industry. Its unique focus and comprehensive coverage provide invaluable insights and opportunities for growth.

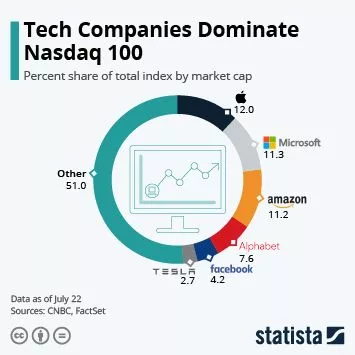

Notable companies listed on Nasdaq FintechZoom

Nasdaq FintechZoom provides investors with a comprehensive list of notable companies in the fintech industry. These companies are at the forefront of financial technology, driving innovation and revolutionizing the way we think about and engage with financial services. By tracking Nasdaq FintechZoom, investors can stay informed about the performance and potential of these influential companies.

One notable company listed on Nasdaq FintechZoom is PayPal Holdings Inc. As a global leader in digital payments, PayPal has transformed the way people send and receive money online. With its user-friendly platform and extensive network, PayPal has become a household name and a key player in the fintech industry.

Another notable company is Square Inc., which is known for its mobile payment solutions and Square Cash App. Square’s technology enables small businesses to accept card payments through their smartphones, making it easier for them to conduct transactions and manage their finances.

Other notable companies listed on Nasdaq FintechZoom include Visa Inc., Mastercard Incorporated, and American Express Company, all of which are major players in the fintech industry.

These companies represent just a fraction of the innovative and influential companies listed on Nasdaq FintechZoom. By paying attention to these notable companies, investors can gain insights into the potential growth and future of the fintech industry.

Potential growth and future projections

The potential growth and future projections for the fintech industry are incredibly promising. As technology continues to advance and consumers increasingly demand convenient and accessible financial solutions, the fintech sector is positioned for significant expansion.

One area of potential growth is in digital payments. With the rise of mobile banking and the increasing popularity of online shopping, the demand for seamless and secure payment methods is skyrocketing. Fintech companies that specialize in digital payment solutions, such as PayPal and Square, are likely to see continued growth as more consumers and businesses adopt these technologies.

Additionally, the lending and investment sectors within fintech are also projected to experience substantial growth. Peer-to-peer lending platforms, robo-advisors, and digital investment platforms are all disrupting traditional financial institutions and offering consumers more options for managing their money. As these technologies become more widely accepted and trusted, the demand for these services will only increase.

Furthermore, the integration of blockchain technology in the fintech industry presents a significant opportunity for growth. Blockchain has the potential to revolutionize not only payment systems but also areas like identity verification, supply chain management, and even voting systems. Fintech companies that leverage blockchain technology are likely to play a major role in these transformative changes.

Overall, the potential for growth and innovation in the fintech industry is vast. Investors who pay attention to Nasdaq FintechZoom can stay informed about these developments and position themselves to take advantage of the numerous opportunities presented by this rapidly evolving sector.

Risks and drawbacks of investing in fintech

While the fintech industry offers promising opportunities for investors, it is important to consider the risks and drawbacks associated with investing in this rapidly evolving sector.

One of the main risks is regulatory uncertainty. Fintech companies often face regulatory challenges as they disrupt traditional financial services. Changes in regulations can have a significant impact on the operations and profitability of fintech companies, making it essential for investors to stay updated on any potential regulatory changes that could affect their investments.

Another risk is cybersecurity. Fintech companies deal with sensitive financial data and are often targeted by hackers. Any breaches in security can result in financial losses for both the company and its investors. It is important for investors to evaluate the cybersecurity measures and protocols in place for the fintech companies they are considering investing in.

Additionally, fintech investments can be highly volatile. The rapidly changing nature of the industry means that new technologies can quickly render existing solutions obsolete. This can lead to significant fluctuations in stock prices, making it crucial for investors to carefully evaluate the long-term viability and competitive advantage of the companies they choose to invest in.

Lastly, competition in the fintech industry is fierce. Established financial institutions are also investing in and developing their own fintech capabilities, which can pose a threat to smaller fintech companies. Investors need to carefully analyze the competitive landscape and assess the potential for a company to maintain its market share in the face of competition.

Overall, while investing in fintech can offer significant rewards, it is essential for investors to consider and manage the risks associated with this rapidly evolving industry. Conducting thorough research and staying informed about the latest developments and challenges in the fintech sector can help investors make more informed investment decisions and mitigate potential risks.

buy bitcoin fintechzoom

If you’re interested in investing in cryptocurrency, particularly Bitcoin, Nasdaq FintechZoom is the perfect tool to help you navigate the market. Bitcoin has been making headlines as one of the most popular and valuable digital currencies, and its potential for growth has caught the attention of many investors.

By tracking Nasdaq FintechZoom, you can stay informed about the performance of Bitcoin and make more informed decisions about when to buy or sell. This index allows you to monitor the price fluctuations of Bitcoin in real-time, giving you valuable insights into the market trends and patterns.

One of the benefits of using Nasdaq FintechZoom to buy Bitcoin is the convenience it offers. Instead of navigating multiple platforms and exchanges to find the best prices, Nasdaq FintechZoom provides a centralized location to track the performance and purchase Bitcoin with ease.

Additionally, Nasdaq FintechZoom provides resources and tools to help you analyze and evaluate the market. You can access historical price charts, technical indicators, and expert analysis to make more informed decisions. Whether you’re a seasoned investor or just starting out in the cryptocurrency market, Nasdaq FintechZoom can provide the information you need to make smart investment choices.

Investing in Bitcoin comes with its own set of risks, and it’s important to do your research and understand the market before diving in. However, with the help of Nasdaq FintechZoom, you can have a better understanding of the market trends and potential opportunities, making it a valuable tool for anyone looking to buy Bitcoin.

fintechzoom auto loan calculator

Are you considering buying a car but not sure if you can afford the monthly payments? Look no further than the FintechZoom Auto Loan Calculator. This handy tool takes the guesswork out of budgeting for your new ride.

With the FintechZoom Auto Loan Calculator, you can easily determine the monthly payment for your desired car based on factors such as the loan amount, interest rate, and loan term. Simply input these details into the calculator, and it will generate an estimate of your monthly payment.

But that’s not all – the FintechZoom Auto Loan Calculator also provides you with a breakdown of the total cost of the loan, including the interest you’ll pay over the life of the loan. This information is invaluable for comparing loan options and finding the most affordable option for your budget.

The calculator is user-friendly and intuitive, making it accessible to both seasoned car buyers and first-time purchasers. It saves you time and effort by eliminating the need for manual calculations and allowing you to make more informed decisions about your car purchase.

Whether you’re buying a brand-new vehicle or a used car, the FintechZoom Auto Loan Calculator is an essential tool for any car buyer. Take advantage of this easy-to-use resource and drive off the lot with confidence.

ripple price fintechzoom

The Ripple price on Nasdaq FintechZoom is an important metric for investors to track. Ripple, also known as XRP, is a digital currency that aims to facilitate fast and low-cost international money transfers. As the third-largest cryptocurrency by market capitalization, Ripple has garnered significant attention in the fintech industry.

Monitoring the Ripple price on Nasdaq FintechZoom allows investors to stay informed about the performance and potential of this digital currency. Fluctuations in the Ripple price can indicate market trends and investor sentiment, which can be valuable for making investment decisions.

The Ripple price on Nasdaq FintechZoom is also influenced by various factors such as market demand, regulatory developments, and partnerships with financial institutions. By staying up to date with the Ripple price on Nasdaq FintechZoom, investors can gain insights into these factors and their potential impact on their investments.

Investing in Ripple carries its own set of risks, as with any investment in cryptocurrencies. Price volatility, regulatory uncertainty, and cybersecurity threats are all important considerations. However, by using Nasdaq FintechZoom to track the Ripple price and staying informed about the latest developments, investors can make more informed decisions and potentially capitalize on the opportunities presented by Ripple and the wider fintech industry.

amazon stock fintechzoom, banking fintechzoom ,fintechzoom cost of living ,buy bitcoin fintechzoom, fintechzoom pricing ,gold price fintechzom ,investment fintechzoom ,money fintechzoom, bitcoin price fintechzoom, hsi fintechzoom ,why fintech zoom ,buy bitcoin fintechzoom free, dis stock fintechzoom ,dogecoin price fintechzoom ,ethereum price fintechzoom ,fintechzoom auto loan calculator,

fintechzoom credit cards ,fintechzoom life insurance, gold price from jan 2022 to today ,how much is an ounce of 24 karat gold worth,

luxury fintechzoom, ripple price fintechzoom, stoxx 600 fintechzoom ,what is fintechzoom ,

Also read:Say Goodbye To Financial Woes With Fintechzoom Loan Calculator